The Australian Manufacturing Workers’ Union (AMWU) has focused its recent submission to the inquiry by the Australian Senate into “The performance of the Australian Securities and Investments Commission” on the issue of phoenix company activity.

The AMWU claims that “ASIC’s failure to adequately hold directors to account has cost millions of dollars worth of unpaid entitlements for employees nationwide. The time is now for action to be taken, impunity to end, and for unscrupulous directors to be held accountable.”

The AMWU submission (21 October 2013) makes four recommendations, namely:

1) Increasing resources and funding to ASIC so that it can properly investigate corporate misbehaviour.

2) A comprehensive review and amendment of s 596AB of the Corporations Act to provide stronger safeguards for employee entitlements and allow for more successful actions by ASIC and liquidators.

3) Introducing a reverse onus procedure by which a director, where there has been an adverse liquidators’ report lodged against them, will be required to ensure that they have acted honestly and responsibly in relation to company affairs.

4) Increasing ASIC’s legislative powers to hold directors and officers personally responsible for unpaid employee entitlements, with a particular focus on phoenix activity.

In expanding on and explaining these recommendations the AMWU says:

1) “ASIC is under-resourced to handle the thousands of complaints submitted to it every year. Regardless of what legislative or regulatory reforms are undertaken, without additionally funding, ASIC will not be able to protect the interests of even the most vulnerable of parties, such as employees. There needs to be a commitment to replace impunity with accountability, and increased resources and funding to ASIC must be the driving force behind this.”

2) “The intention behind s 596AB was to “deter the misuse of company structures … to avoid the payment of amounts to employees that they are entitled to prove for on liquidation of their employer”. This intention has not materialised. Instead, the criticism that s 596AB will prove to be a “toothless tiger… so hard to prove that nobody will be effectively prosecuted” has been proven true. This recommendation would allow for ASIC to, more easily, bring proceedings against directors who have compromised employee entitlements through corporate restructures. This would have a threefold effect of protecting employee entitlements, holding dishonest directors to account, and deterring similar conduct.”

3) “This recommendation is modelled upon Irish legislation under the Companies Act 1990 (Ireland) s 149. In Ireland, where an adverse liquidators’ report has been lodged, directors must ensure that a large amount of equity capital is invested in the new company (at least £100 000 with a minimum of £20 000 paid up in cash) or are required to prove in court why they should not be required to do so. This reverse onus procedure would reduce the detection and compliance burden on ASIC.”

4) “The AMWU submits that continued review of the anti-phoenix activity measures implemented be undertaken, especially in light of the first anniversary of the enactment of the Corporations Amendment (Phoenixing and Other Measures) Act 2012 (Cth).”

In support of its submission the AMWU gives its summary of the following recent cases:

• Steel Tube Pipe Group

• Forgecast Australia Pty Ltd (AMWU v Beynon [2013] FCA 390)

• Carlton Sheet Metal Pty Ltd

• Huon Corporation

• Paragon Printing Ltd

The inquiry by the Senate Standing Committee on Economics began on 20 June 2013. Submissions were to close on 21 October 2013. The Committee is due to report by 31 March 2014.

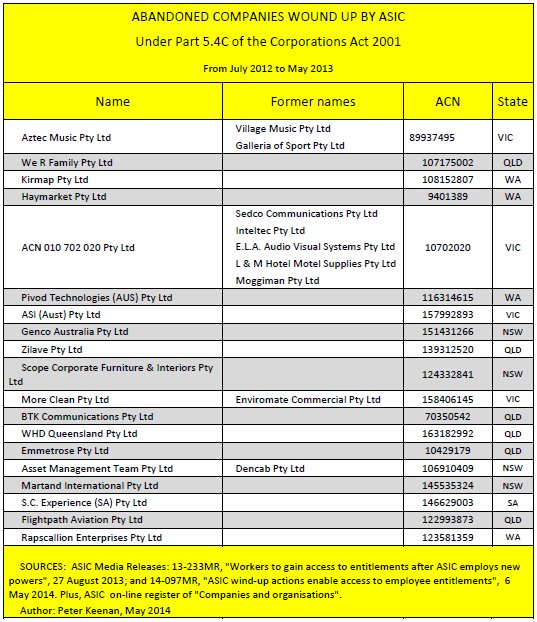

The Australian Securities and Investments Commission (ASIC) has reported on two successful convictions against directors for breaching their duties, in that they engaged in illegal phoenix activities.

The Australian Securities and Investments Commission (ASIC) has reported on two successful convictions against directors for breaching their duties, in that they engaged in illegal phoenix activities.