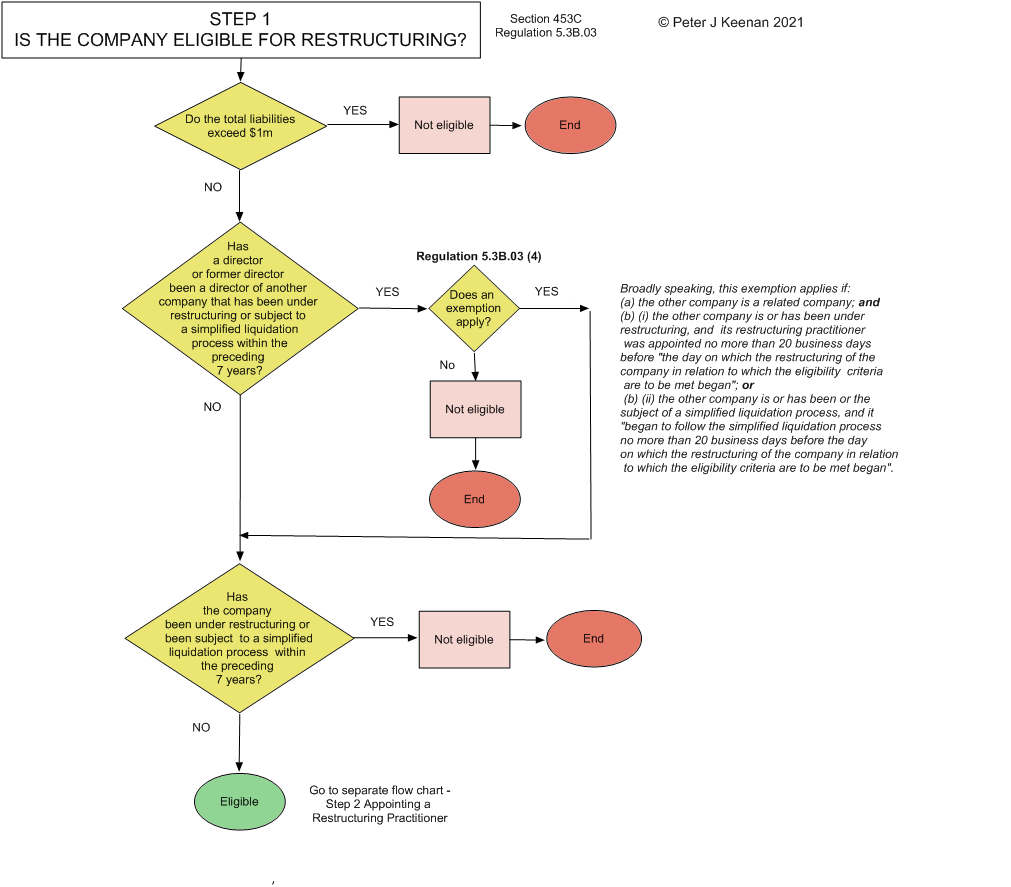

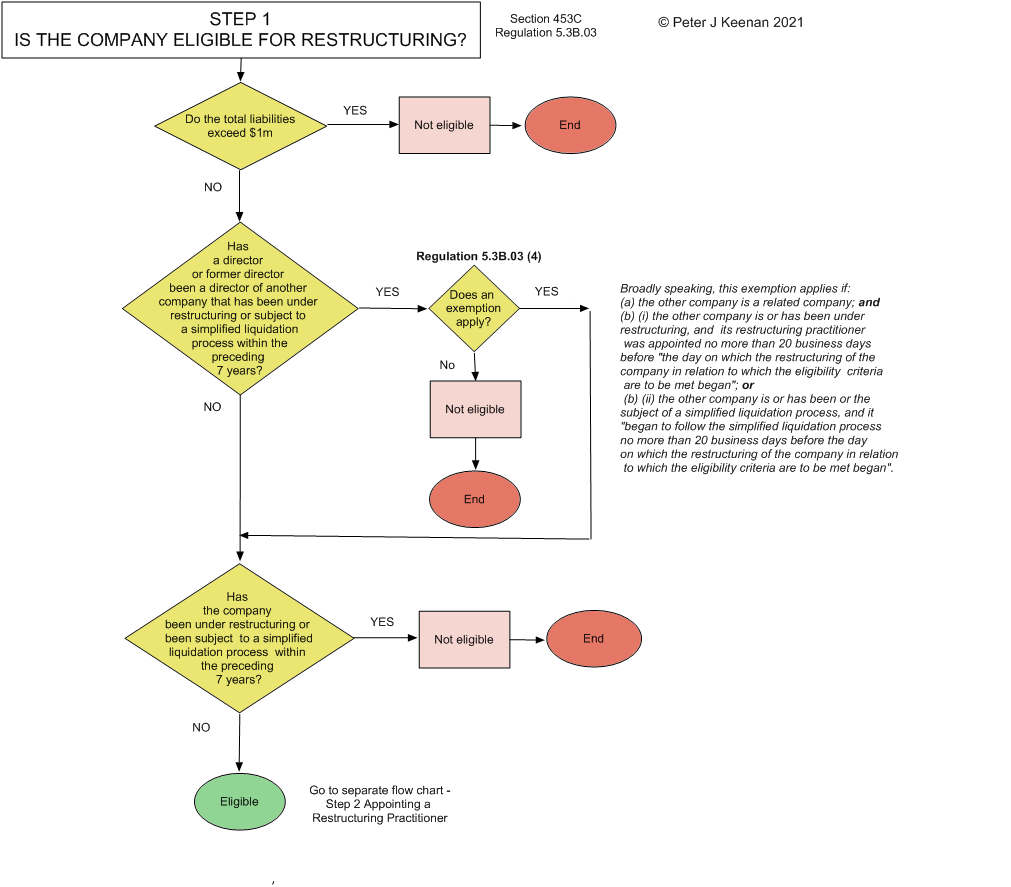

Decide by following this flow chart:

The Turnbull Government is taking action to crack down on illegal phoenixing activity that costs the economy up to $3.2 billion per year to ensure those involved face tougher penalties, the Minister for Revenue and Financial Services, the Hon Kelly O’Dwyer MP, announced today.

Phoenixing – the stripping and transfer of assets from one company to another by individuals or entities to avoid paying liabilities – has been a problem for successive governments over many decades. It hurts all Australians, including employees, creditors, competing businesses and taxpayers.

The Government’s comprehensive package of reforms will include the introduction of a Director Identification Number (DIN) and a range of other measures to both deter and penalise phoenix activity.

The DIN will identify directors with a unique number, but it will be much more than just a number. The DIN will interface with other government agencies and databases to allow regulators to map the relationships between individuals and entities and individuals and other people.

In addition to the DIN, the Government will consult on implementing a range of other measures to deter and disrupt the core behaviours of phoenix operators, including non-directors such as facilitators and advisers. These include: Continue reading »

In its report “Insolvency in the Australian construction industry: I just want to be paid” – published 3 December 2015 – the Senate Committee states:

The committee considers that the estimates of the incidence of illegal phoenix activity detailed in this report suggest that construction industry is being beset by a growing culture among some company directors of disregard for the corporations law. This view is reinforced by the anecdotal evidence received by the committee which indicates that phoenixing is considered by some in the industry as merely the way business is done in order to make a profit.

The committee is particularly concerned at evidence that a culture has developed in sections of the industry in which some company directors consider compliance with the corporations law to be optional, because the consequences of non-compliance are so mild and the likelihood that unlawful conduct will be detected is so low.

This culture is reflected in the number of external administrator reports indicating possible breaches of civil and criminal misconduct by company directors in the construction industry. Over three thousand possible cases of civil misconduct and nearly 250 possible criminal offences under the Corporations Act 2001 were reported in a single year in the construction industry. This is a matter for serious concern. It suggests an industry in which company directors’ contempt for the rule of law is becoming all too common.

[from Executive summary, Phoenixing (page xix) and paragraph 5.100 (page 87)]

Continue reading »

A list of the public hearings and those who appeared as witnesses is provided below. Continue reading »

The AMWU claims that “ASIC’s failure to adequately hold directors to account has cost millions of dollars worth of unpaid entitlements for employees nationwide. The time is now for action to be taken, impunity to end, and for unscrupulous directors to be held accountable.”

The AMWU submission (21 October 2013) makes four recommendations, namely:

1) Increasing resources and funding to ASIC so that it can properly investigate corporate misbehaviour.

2) A comprehensive review and amendment of s 596AB of the Corporations Act to provide stronger safeguards for employee entitlements and allow for more successful actions by ASIC and liquidators.

3) Introducing a reverse onus procedure by which a director, where there has been an adverse liquidators’ report lodged against them, will be required to ensure that they have acted honestly and responsibly in relation to company affairs.

4) Increasing ASIC’s legislative powers to hold directors and officers personally responsible for unpaid employee entitlements, with a particular focus on phoenix activity.

In expanding on and explaining these recommendations the AMWU says:

1) “ASIC is under-resourced to handle the thousands of complaints submitted to it every year. Regardless of what legislative or regulatory reforms are undertaken, without additionally funding, ASIC will not be able to protect the interests of even the most vulnerable of parties, such as employees. There needs to be a commitment to replace impunity with accountability, and increased resources and funding to ASIC must be the driving force behind this.”

2) “The intention behind s 596AB was to “deter the misuse of company structures … to avoid the payment of amounts to employees that they are entitled to prove for on liquidation of their employer”. This intention has not materialised. Instead, the criticism that s 596AB will prove to be a “toothless tiger… so hard to prove that nobody will be effectively prosecuted” has been proven true. This recommendation would allow for ASIC to, more easily, bring proceedings against directors who have compromised employee entitlements through corporate restructures. This would have a threefold effect of protecting employee entitlements, holding dishonest directors to account, and deterring similar conduct.”

3) “This recommendation is modelled upon Irish legislation under the Companies Act 1990 (Ireland) s 149. In Ireland, where an adverse liquidators’ report has been lodged, directors must ensure that a large amount of equity capital is invested in the new company (at least £100 000 with a minimum of £20 000 paid up in cash) or are required to prove in court why they should not be required to do so. This reverse onus procedure would reduce the detection and compliance burden on ASIC.”

4) “The AMWU submits that continued review of the anti-phoenix activity measures implemented be undertaken, especially in light of the first anniversary of the enactment of the Corporations Amendment (Phoenixing and Other Measures) Act 2012 (Cth).”

In support of its submission the AMWU gives its summary of the following recent cases:

• Steel Tube Pipe Group

• Forgecast Australia Pty Ltd (AMWU v Beynon [2013] FCA 390)

• Carlton Sheet Metal Pty Ltd

• Huon Corporation

• Paragon Printing Ltd

The inquiry by the Senate Standing Committee on Economics began on 20 June 2013. Submissions were to close on 21 October 2013. The Committee is due to report by 31 March 2014.

To see the Explanatory Memorandum and/or the Exposure Draft Legislation CLICK HERE.

Closing date for submissions: Monday, 1 August 2011

I intend to write more about this soon.

The following are extracts from the judgement of Middleton, J on 27 June 2011 in Australian Securities and Investments Commission v Healey [2011] FCA 717:

“The central question in the proceeding has been whether directors of substantial publicly listed entities are required to apply their own minds to, and carry out a careful review of, the proposed financial statements and the proposed directors’ report, to determine that the information they contain is consistent with the director’s knowledge of the company’s affairs, and that they do not omit material matters known to them or material matters that should be known to them.

A director is an essential component of corporate governance. Each director is placed at the apex of the structure of direction and management of a company. The higher the office that is held by a person, the greater the responsibility that falls upon him or her. The role of a director is significant as their actions may have a profound effect on the community, and not just shareholders, employees and creditors.

This proceeding involves taking responsibility for documents effectively signed-off by, approved, or adopted by the directors. What is required is that such documents, before they are adopted by the directors, be read, understood and focussed upon by each director with the knowledge each director has or should have by virtue of his or her position as a director. I do not consider this requirement overburdens a director, or as argued before me, would cause the boardrooms of Australia to empty overnight. Directors are generally well remunerated and hold positions of prestige, and the office of director will continue to attract competent, diligence and intelligent people.

The case law indicates that there is a core, irreducible requirement of directors to be involved in the management of the company and to take all reasonable steps to be in a position to guide and monitor. There is a responsibility to read, understand and focus upon the contents of those reports which the law imposes a responsibility upon each director to approve or adopt.

All directors must carefully read and understand financial statements before they form the opinions which are to be expressed in the declaration required by s 295(4). Such a reading and understanding would require the director to consider whether the financial statements were consistent with his or her own knowledge of the company’s financial position. This accumulated knowledge arises from a number of responsibilities a director has in carrying out the role and function of a director. These include the following: a director should acquire at least a rudimentary understanding of the business of the corporation and become familiar with the fundamentals of the business in which the corporation is engaged; a director should keep informed about the activities of the corporation; whilst not required to have a detailed awareness of day-to-day activities, a director should monitor the corporate affairs and policies; a director should maintain familiarity with the financial status of the corporation by a regular review and understanding of financial statements; a director, whilst not an auditor, should still have a questioning mind.

A board should be established which enjoys the varied wisdom, experience and expertise of persons drawn from different commercial backgrounds. Even so, a director, whatever his or her background, has a duty greater than that of simply representing a particular field of experience or expertise. A director is not relieved of the duty to pay attention to the company’s affairs which might reasonably be expected to attract inquiry, even outside the area of the director’s expertise.

The words of Pollock J in the case of Francis v United Jersey Bank (1981) 432 A 2d 814, quoted with approval by Clarke and Sheller JJA in Daniels v Anderson (1995) 37 NSWLR 438, make it clear that more than a mere ‘going through the paces’ is required for directors. As Pollock J noted, a director is not an ornament, but an essential component of corporate governance.

Nothing I decide in this case should indicate that directors are required to have infinite knowledge or ability. Directors are entitled to delegate to others the preparation of books and accounts and the carrying on of the day-to-day affairs of the company. What each director is expected to do is to take a diligent and intelligent interest in the information available to him or her, to understand that information, and apply an enquiring mind to the responsibilities placed upon him or her. Such a responsibility arises in this proceeding in adopting and approving the financial statements. Because of their nature and importance, the directors must understand and focus upon the content of financial statements, and if necessary, make further enquiries if matters revealed in these financial statements call for such enquiries.

No less is required by the objective duty of skill, competence and diligence in the understanding of the financial statements that are to be disclosed to the public as adopted and approved by the directors.

No one suggests that a director should not personally read and consider the financial statements before that director approves or adopts such financial statements. A reading of the financial statements by the directors is not merely undertaken for the purposes of correcting typographical or grammatical errors or even immaterial errors of arithmetic. The reading of financial statements by a director is for a higher and more important purpose: to ensure, as far as possible and reasonable, that the information included therein is accurate. The scrutiny by the directors of the financial statements involves understanding their content. The director should then bring the information known or available to him or her in the normal discharge of the director’s responsibilities to the task of focussing upon the financial statements. These are the minimal steps a person in the position of any director would and should take before participating in the approval or adoption of the financial statements and their own directors’ reports.

The omissions in the financial statements the subject of this proceeding were matters that could have been seen as apparent without difficulty upon a focussing by each director, and upon a careful and diligent consideration of the financial statements. As I have said, the directors were intelligent and experienced men in the corporate world. Despite the efforts of the legal representatives for the directors in contending otherwise, the basic concepts and financial literacy required by the directors to be in a position to properly question the apparent errors in the financial statements were not complicated.”

The full judgement in Australian Securities and Investments Commission v Healey [2011] FCA 717 may be accessed HERE.

The Budget paper describes fraudulent phoenix activity as:

“… which involves a company intentionally accumulating debts to improve cash flow or wealth and then liquidating to avoid paying the debt. The business is then continued as another corporate entity, controlled by the same person or group and free of their previous debts and liabilities.”

This measure is estimated to result in an additional $260 million in revenue in fiscal balance terms over the forward estimates period. There is a related increase in ATO departmental expenses of $22.1 million over the same period. In underlying cash terms, the estimated increase in receipts is $245 million over the forward estimates period.

See http://www.budget.gov.au/2011-12/content/bp2/html/bp2_revenue-07.htm