Australia’s Accounting Professional and Ethical Standards Board (ASESB) is revising the professional standard that governs accountants in public practice who perform insolvency services.

On 21 May 2014 ASESB issued an exposure draft of the proposed revisions. It is seeking feedback from insolvency accountants and “other stakeholders” by 4 July 2014.

Chairman of ASESB, Stuart Black, says

“The proposed new requirements to (the professional standard) APES 330 will further strengthen the professional requirements applicable to liquidators and administrators and provide a reference for creditors, regulators and other stakeholders to evaluate and monitor practitioner conduct”

The Media Release states that:

“APESB sets the code of ethics and professional standards by which members of Australia’s three major professional accounting bodies (CPA Australia, the Institute of Chartered Accountants Australia and the Institute of Public Accountants) are required to abide.”

Overview of the proposed changes

The exposure draft contains the following list of “significant revisions” to the existing APES 330:

-

Revision or addition of the following definitions: Administration, Appointment, Approving Body, Contingent Fee, Controller, Firm, Independence, Insolvency Services, Insolvent Debtor, Member, Member in Public Practice, Professional Activity, Professional Bodies, Professional Services, Professional Standards, Referring Entity, and Related Entity;

-

Removal of the defined terms: Associated Entity, Controlled Entity, and Witness Report;

-

Extending the scope of the standard to include members’ voluntary liquidations with the exception of having to comply with the Independence requirements of the standard;

-

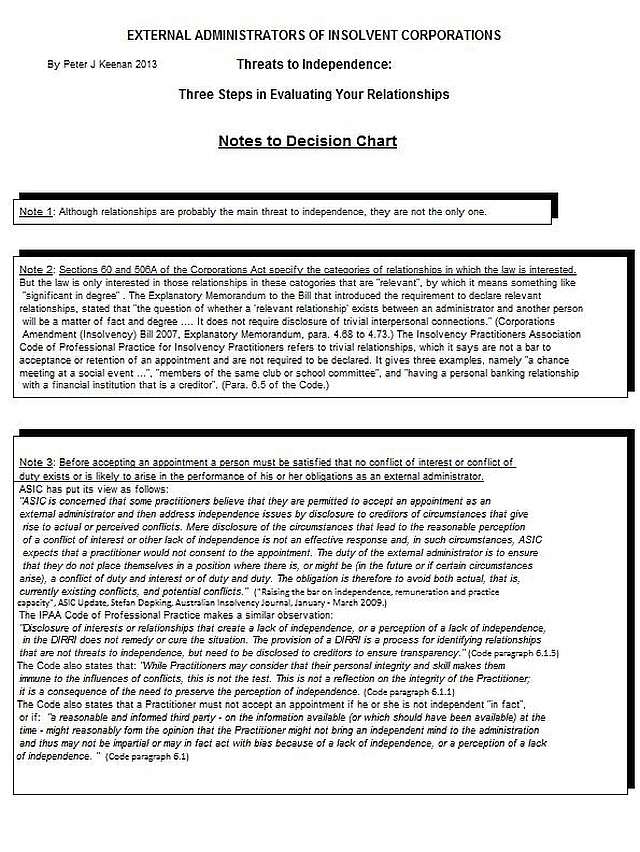

Introduction of a requirement to disclose the source of a referral where the Appointment follows a specific referral;

-

Introduction of a requirement to declare in the DIRRI that no information or advice, beyond that outlined in the DIRRI, was provided;

-

Use of the term “believing” to clarify that it is the Member in Public Practice’s reasons for believing that the Pre-appointment Advice provided or the relationship disclosed does not result in a conflict of interest or duty;

-

Extension of the prohibition on providing Pre-appointment Advice to both an insolvent Entity and its directors; to include an Insolvent Debtor and any corporate Entity associated with that individual;

-

New guidance to encourage disclosure of relationships with Associates of the insolvent Entity that were more than two years prior to the Appointment;

-

Amendment of the current prohibition of consenting to an Appointment where prior business dealings were held to exclude immaterial dealings, or those business dealings that occurred more than two years prior to the Appointment;

-

Additional guidance on what is considered a material business relationship;

-

A new requirement to provide the basis of fee calculations and where relevant the scale

-

Mandating that where fee estimates are provided that these be provided in writing with explanations of the variables that may affect the estimated fee;

-

An obligation on the Member in Public Practice to provide details of Expenses that may be charged from the Administration and the basis of how the Expenses will be charged and recovered by the Firm;

-

Prohibition of Members in Public Practice claiming any pre-appointment disbursements as an Expense;

-

Requirement for consistency between fees charged and those sought for prospective fee approval;

-

The scale of rates used to calculate prospective fees must be that approved by the Approving Body

-

Where a Member in Public Practice accepts an Appointment with another Member, all Members are equally responsible for all decisions on the Appointment;

-

Payments received for the costs of an Administration from third parties must be disclosed to the Approving Body and approved (other than in an Appointment as a Controller);

-

Detailed requirements and guidance on Expert Witness obligations has been replaced by referring Members in Public Practice to APES 215 Forensic Accounting Services; and

-

New requirements for a Member in Public Practice to use appropriate procedures to ensure statutory timeframes are met in a timely manner.

Deadline for comments

The deadline for stakeholder comments is 4 July 2014. APESB says it welcomes comments from respondents on any matters in the exposure draft (ED 01/14).

Comments should be addressed to:

The Chairman, Accounting Professional & Ethical Standards Board Limited

Level 7, 600 Bourke Street, MELBOURNE, VIC, 3000.

A copy of each submission will be placed on public record on the APESB website. http://www.apesb.org.au/apesb-exposure-drafts-open-for-comment.

Sources and Links

APESB Media Release 21 May 2014

APESB At A Glance, APES 330 Insolvency Services ED, May 2014

Proposed Standard: apes 330 Insolvency Services

Footnote

The Australian Restructuring Insolvency & Turnaround Association (ARITA) also has an extensive Code of Professional Practice. That governs members of ARITA, but has also been accepted by some judges in hearings concerning misconduct as a guide to the professional standards expected of all insolvency practitioners. Accordingly, the changes by the accounting bodies to APES 330 may not make much real difference to practice standards. But of course the accounting bodies must have their own rules in place.