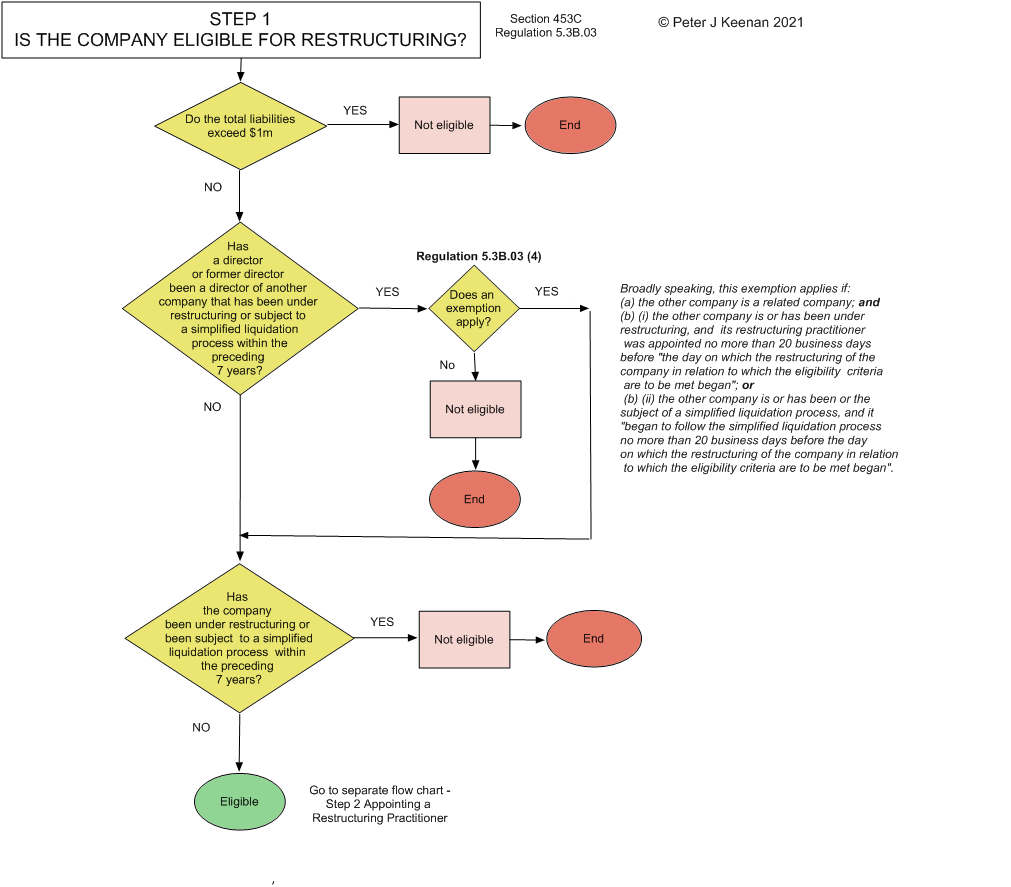

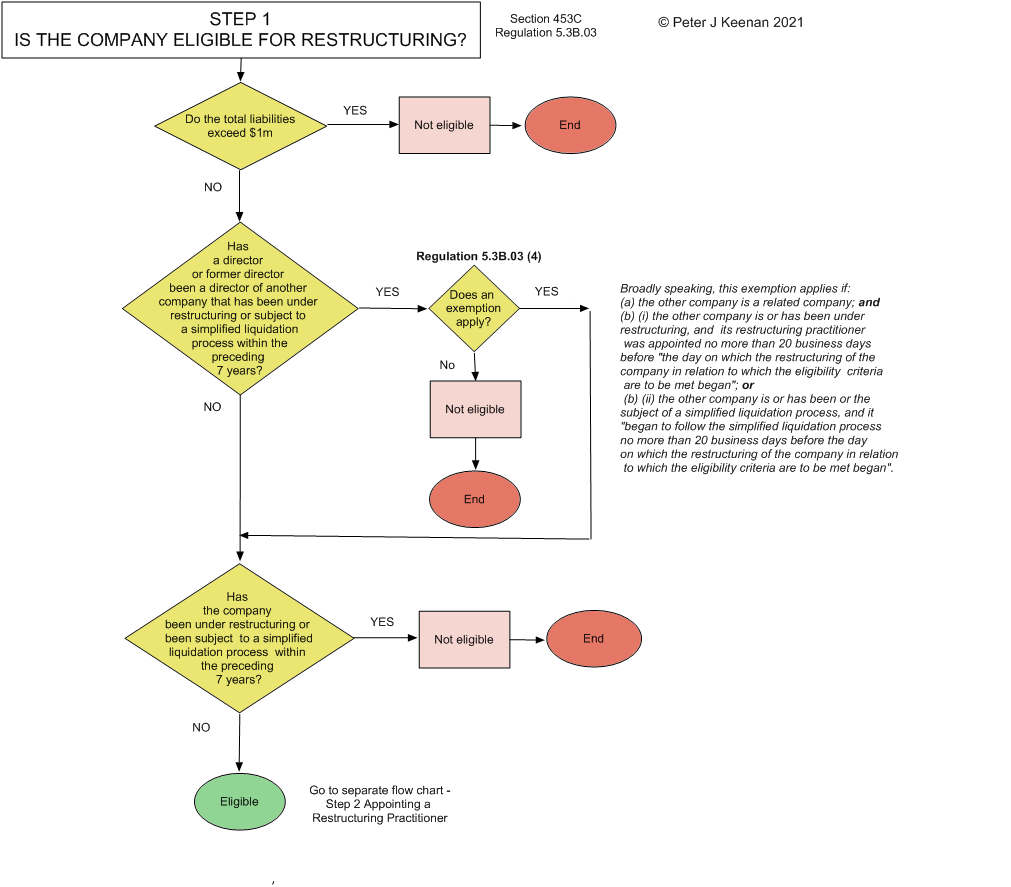

Decide by following this flow chart:

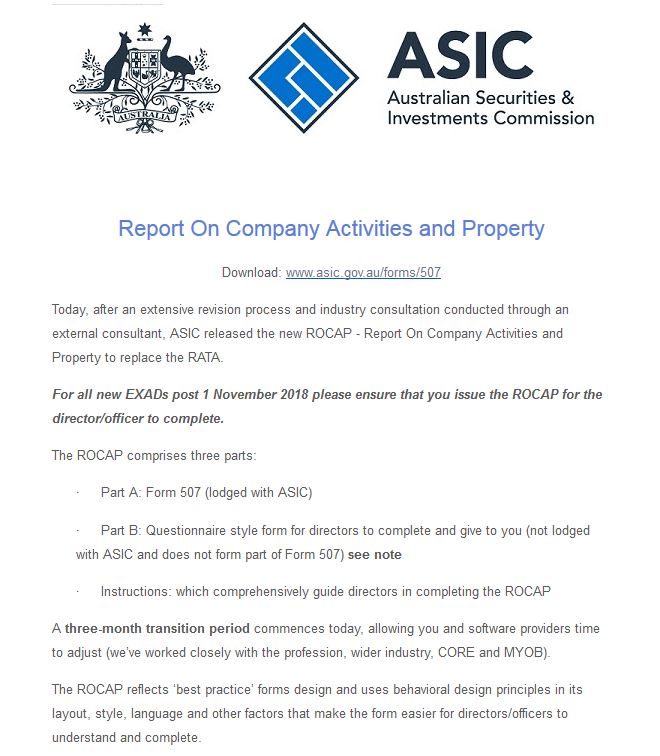

In an email to liquidators on 1 November 2018 the Australian Securities and Investments Commission has notified liquidators that its Report as to Affairs (RATA) form – Form 507 – is to be replaced by its new Report On Company Activities and Property (ROCAP) form – which comprises a new Form 507 plus a questionnaire. Directors and officers of companies entering into insolvent administration are required to complete the form and questionnaire.

Liquidators have been asked to issue the new ROCAP to directors for all new External Administrations after 1 November 2018, but says there will be a three-month transition period to allow software providers to catch up with the change.

A copy of the email is reproduced below.

For more about the new form and questionnaire, see my post “Framework of new Report as to Affairs (RATA) drafted by ASIC” (19/10/2018).

The new forms are available from ASIC: click HERE for the new ROCAP and HERE for the Instructions.

For more in this subject see my post of 22 June 2019: “Creators of ASIC’s ROCAP documents describe their process.”

![]() On 1 October 2018 the Australian Securities and Investments Commission (ASIC) released a draft of a new Report as to Affairs (commonly known as a RATA). A copy of this form, which includes detailed instructions, may be downloaded from my website or from this ASIC journal.

On 1 October 2018 the Australian Securities and Investments Commission (ASIC) released a draft of a new Report as to Affairs (commonly known as a RATA). A copy of this form, which includes detailed instructions, may be downloaded from my website or from this ASIC journal.

The new name of the report is to be Report On Company Activities and Property (ROCAP). ASIC intends releasing it in November 2018.

The following comments outline my preliminary analysis of the draft. Continue reading »

With the commencement on 1 September 2017 of the delayed parts of the Insolvency Law Reform Act 2016 (the ILRA), the Australian Securities and Investments Commission (ASIC) has updated some of the Information Sheets which it makes available on its website to the general public.

ASIC says that “Information sheets provide concise guidance on a specific process or compliance issue or an overview of detailed guidance.”

Over time ASIC has issued about 36 insolvency information sheets and flow charts (click here for my list). Below is a list of 15 which have recently been reissued.

In the past, nearly all ASIC’s information sheets have been available to download as printable sheets in PDF file format. However, this facility has not (yet) been provided with the updated/reissued sheets, which are only available as text on ASIC web pages. The links below are to the relevant website pages.

ASIC INSOLVENCY INFORMATION SHEETS – REISSUED 1 SEPTEMBER 2017 |

|||

Form Number |

Title of Sheet |

Date Updated |

Link to ASIC site |

| INFO 39 | Insolvency information for directors, employees, creditors and shareholders |

1/9/2017 |

INFO 39 |

| INFO 41 | Insolvency: A glossary of terms | 1/9/2017 | INFO 41 |

| INFO 42 | Insolvency: a guide for directors | 1/9/2017 | INFO 42 |

| INFO 43 | Insolvency: a guide for shareholders | 1/9/2017 | INFO 43 |

| INFO 45 | Liquidation: a guide for creditors | 1/9/2017 | INFO 45 |

| INFO 46 | Liquidation: a guide for employees | 1/9/2017 | INFO 46 |

| INFO 53 | Providing assistance to external administrators – Books, records and RATA | 1/9/2017 | INFO 53 |

| INFO 54 | Receivership: a guide for creditors | 1/9/2017 | INFO 54 |

| INFO 55 | Receivership: a guide for employees | 1/9/2017 | INFO 55 |

| INFO 74 | Voluntary administration: a guide for creditors | 1/9/2017 | INFO 74 |

| INFO 75 | Voluntary administration: a guide for employees | 1/9/2017 | INFO 75 |

| INFO 84 | Independence of external administrators: a guide for creditors | 1/9/2017 | INFO 84 |

| INFO 85 | Approving fees: a guide for creditors | 1/9/2017 | INFO 85 |

| INFO 152 | Public comment on ASIC’s regulatory activities | 1/9/2017 | INFO 152 |

| INFO 212 | Illegal phoenix activity | 1/9/2017 | INFO 212 |

With the commencement on 1 September 2017 of the delayed parts of the Insolvency Law Reform Act 2016 (the ILRA), the Australian Restructuring Insolvency & Turnaround Association (ARITA) has updated the Insolvency Explained section of its website which provides information to stakeholders in the insolvency process, and has developed a range of information sheets designed to assist creditors with understanding insolvency processes.

This is a guide to ARITA’s information, with links to the relevant website pages.

The ARITA insolvency information sheets listed below may be downloaded from the page headed “Insolvency information sheets”. They are all in PDF format. ….. CLICK HERE

The ILRA reform provisions relating to the rules and conduct of external administrations, commenced on 1 September 2017. This followed ILRA reform provisions relating to the registration and discipline of registered liquidators, and provisions relating to matters such as notification of contravention of a Deed of Company Arrangement and lodgement of a declaration of relevant relationships and declaration of indemnities in a voluntary administration, which commenced on 1 March 2017.

Parliament passed the Insolvency Law Reform Act 2016 (the ILRA) on 22 February 2016. The government registered the related Insolvency Practice Rules (Corporations) 2016 (the Rules) in December 2016. The ILRA and Rules change the law relating to the registration and discipline of liquidators and the conduct of external administrations.

In reporting on the results of an investigation into the conduct of a Victorian registered liquidator operating as a sole practitioner, the Australian Securities and Investments Commission (ASIC) has provided a list of procedures which the liquidator failed to carry out.

The catalogue serves both as a guide to some of the duties that ASIC regards as important, and as a reminder to liquidators.

ASIC’s concerns centred on alleged failures to:

- conduct pre-appointment independence reviews;

- send to third parties adequate ‘Day One’ correspondence;

- properly investigate company affairs;

- take steps to protect and secure assets in a timely manner;

- adequately investigate potential illegal phoenix activities and taxation offences of directors and their advisors;

- make sufficient requests of company officers for books and records;

- seek prompt assistance from ASIC under the Liquidator Assistance program where the company director or accountant failed to provide adequate books and records;

- undertake adequate review of voidable transactions, including unfair preferences and uncommercial transactions;

- lodge complete reports with ASIC;

- provide creditors with adequate reporting to enable informed assessment of remuneration requests and may have drawn remuneration he was not entitled to; and

- comply with legal requirements to document work undertaken.

Not each and every one of ASIC’s concerns were found in all of the external administrations reviewed.

ASIC Commissioner John Price said, ‘ASIC continues its focus on registered liquidators who fail to carry out their legal obligations to carry out adequate investigations and report fully to creditors, including in circumstances suggesting pre-appointment illegal activity.

‘Creditors have every right to expect registered liquidators to act independently and competently – especially given their role as a fiduciary. The community needs to have trust and confidence in the administration of insolvent companies.

‘ASIC will continue to review and take action against liquidators whom ASIC believes fall short of meeting legal and professional standards.’

(24 June 2015: copyright P J Keenan)

| Resolutions by shareholders to wind up the company and to appoint a liquidator |

| Liquidator takes control of business, property and affairs |

| Liquidator prepares report of proposed remuneration |

| Liquidator makes declarations of indemnities, up-front payments and relevant relationships |

| Directors’ statement about business, property, affairs and financial circumstances of company (Report as to Affairs) |

| Meeting of creditors (possible committee of inspection; fix remuneration of liquidator; confirm or change liquidator; etc.) |

| Investigations, realisations of assets and unpaid share capital, recovery of property and (possibly) recovery of compensation | Liquidator’s statutory reporting, accounts and returns |

| Examination and determination of creditors claims | Payment of expenses and liquidator’s remuneration |

| Distribution of residual funds to creditors | Annual meeting of creditors or annual report |

| Final meeting of creditors and shareholders |

| Deregistration of the company |

LAW: Corporations Act 2001, Chapter 5; Corporations Regulations 2001.

PRACTICE STANDARDS: The Third Edition of the Code of Professional Practice of the Australian Restructuring Insolvency & Turnaround Association

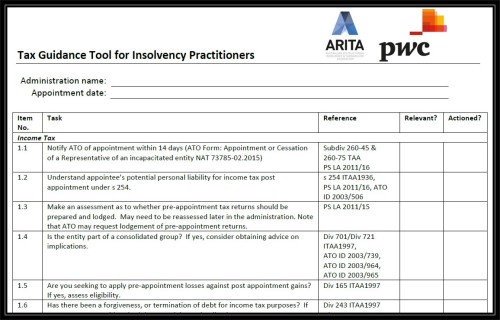

The checklist has 57 questions, alerts, recommendations and tasks concerning income tax, goods and services tax, fringe benefits tax, PAYG withholding, and superannuation guarantee.

ARITA suggests that “Members should note that while ARITA will endeavour to ensure that this guidance is kept up to date, tax is an area subject to constant change and the guidance is current, to the best of our knowledge, as at the date included in the footer of the document. Members should ensure that they are always using the most current version of the guidance”.

The checklist is intended to provide assistance and help to insolvency practitioners in the complicated field of tax compliance. There is no suggestion from ARITA that use of their tax guide is mandatory or necessary or even recommended.

Extract from ARITA tax guide

Access to the full guide is available through the ARITA website: CLICK HERE.

From ARITA on 13 July:

ARITA has received a number of queries from members regard the relevant PAYG Withholding Rates for dividends paid to employees by external administrators in light of the increase to the Medicare Levy.

On consultation with the ATO, we have been advised that the 2005 Notice of Variation is still current and the 31.5% standard rate still applies and will continue to do so until the notice of variation ceases on 1 October 2015.

The ATO further advises that it is looking to renew the notice but before that occurs will consult with relevant stakeholders, including ARITA and external administrators, about whether changes need to or should be made to the current notice, including any changes to the rates on the notice.

UPDATED 16/1/2015

Despite directors receiving official admonishments, detailed instructions and threats about the practice of allowing a company to trade whilst insolvent (see, for example, ASIC Regulatory Guide 217), the curse of insolvent trading seems to be growing.

So, in an attempt to reel it in – or perhaps (for the cynical) to reduce the number of reported cases – the Australian Securities and Investments Commission (ASIC) is putting the onus on liquidators to provide “better” information in their statutory reports.

Where liquidators of insolvent companies become aware that a past or present director or other officer of a company may have committed an offence, they are required to make a formal report to ASIC. Several years ago ASIC came up with a form and guidelines spelling out the information it wanted from liquidators before it would take their allegations of offences any further. This change came with the introduction of an electronic means of lodging reports, but also occurred after ASIC had become fed-up with receiving offence reports considered by its investigators to be almost worthless.

The latest version of this offence report form was released on 18 December 2014. The changes that have been drawn to the attention of liquidators by ASIC concern allegations of insolvent trading. The previous version of the form (July 2008) asked little of liquidators regarding this subject: about all it wanted was a “Yes” or “No” on the availability of documentary evidence. But the new version requires far more.

In the insolvency profession the ASIC form is known as EX01. More technically it is Schedule B of Regulatory Guide 16: Report to ASIC under s422, s438D or s533 of the Corporations Act 2001 or for statistical purposes. (Note: This reporting requirement applies not only to liquidators but also to receivers or managing controllers and voluntary administrators. However for simplicity all these classes of external administrators are referred to collectively in this article as liquidators.)

In EX01 reporting of “insolvent trading” is carried out in the section headed Possible Misconduct.

Here, ASIC asks the liquidator “Are you reporting possible misconduct?”

If the answer is “Yes”, the liquidator is invited to examine Schedule D of ASIC Regulatory Guide 16 to learn “what is likely to constitute a breach of the relevant section, and the evidence needed to prove such a breach”. Schedule D contains over 6,500 words.

There is also a warning “that ASIC may ask you to provide a supplementary report addressing in detail the possible misconduct reported and we may later require further evidence or statements from you for Court purposes”. A description of what is required in the ASIC supplementary report is set out in Schedule C: Supplementary report by receiver or managing controller under s422(2), by voluntary administrator under s438D(2), or by liquidator under s533(2). Schedule C contains about 3,000 words. Liquidators of “assetless companies” are eligible under Regulatory Guide 109 to apply for funding from ASIC for reasonable remuneration and costs in preparing a supplementary report (ASIC form EX03).

If, after considering what is involved in answering “Yes”, the liquidator still thinks the misconduct is worth reporting, or filing a complaint, he or she is directed to the section headed “Criminal Offences”.

Preliminary details of an allegation of insolvent trading – an offence under section 588G(3) of the Corporations Act 2001 – are sought by ASIC in the usual tick-the-box manner.

First the liquidator reports the alleged offence by ticking “Yes” to the following statement:

“In your opinion, one or more directors failed to prevent the company incurring a debt or debts at a time when the director suspected that the company was insolvent or would become insolvent as a result, and the failure to prevent the company incurring the debt(s) was dishonest.”

Having ticked that box, the liquidator is asked “Do you have documentary evidence or other to support your opinion?” and “Are you aware of documentary evidence in the possession of another person that supports this allegation?”

Up to this section the revised form is practically the same as the previous version.

But in the new version, if the liquidator reports a case of insolvent trading and has, or knows of, documentary evidence supporting this conclusion, the liquidator must provide more information by answering several extra questions.

These extra questions concern the period of insolvency, the methods and records used to determine the date of insolvency, the amount of debts incurred, and the reasonable grounds for the director had to suspect insolvency. (The actual questions are set out verbatim below, but the heading are mine.) They are the type of questions that a liquidator, especially one with sufficient funds, ought to consider as a matter of course before reaching an opinion regarding the existence (or non-existence) of insolvent trading.

Prior to the recent changes, if ASIC saw a completed EX01 form in which the liquidator had alleged a breach of the insolvent trading laws, and had also answered “yes” to questions about the possession or existence of documentary evidence “or other” to support that opinion, ASIC would have then needed to consider whether to investigate. Its task would likely have entailed obtaining, or trying to obtain, from the liquidator the extra information that is now set out in the latest version of EX01. So, as far as the extra demands in the form are concerned, ASIC would probably argue that liquidators are no greater imposed upon now than they were before.

But regardless of the information ASIC has or could readily obtain, it often decides not to investigate complaints of alleged offences. For many years this inaction has deeply frustrated a lot of liquidators. Many feel that completing an EX01 form is a waste of their time and also, where there are still funds in the insolvent company, a waste of creditors’ money. Unless the revised EX01 results in greater tangible action by ASIC (increased investigations and prosecutions and not just more detailed statistics), making the form more demanding will aggravate these feelings.

It might even see an increase in the non-reporting of insolvent trading offences (see the new question “Reasons for not reporting insolvent trading”), or in “no” being the liquidator’s response when it really should be “yes”.

Indicate the period, which, in your opinion, the company became unable to pay all its debts as and when they became due and payable:

◻ At appointment ◻ 1 – 3 months prior to appointment ◻ 4 – 9 months prior to appointment ◻ 10 – 15 months prior to appointment ◻ 16 – 24 months prior to appointment ◻ Over 2 years prior to appointment

How did you determine the date on which, in your opinion, the company became unable to pay all its debts as and when they became due and payable? (tick one or more):

◻ Cash flow analysis ◻ Trading history analysis ◻ Balance sheet analysis ◻ Informed by director(s) ◻Other, please specify __________________

Which of the following records, in your possession, did you use to determine the date on which, in your opinion, the company became unable to pay all its debts? (tick one or more):

◻ Cash flow (actual / forecasts / budgets) ◻ Banking records ◻ Aged debtors’ list ◻ Aged creditors’ list ◻ Profit & loss statements ◻ Balance sheets ◻ Other, please specify _______________

If you believe the director had reasonable grounds to suspect the company was insolvent or would become insolvent by incurring the debt (or a reasonable person in a like position would have reason to suspect), please identify on which of the following indicators of insolvency you have based your belief (tick one or more):

◻ Financial statements that disclose a history of serious shortage of working capital, unprofitable trading ◻ Poor or deteriorating cash flow or evidence of dishonoured payments ◻ Difficulties paying debts when they fell due (e.g. evidenced by letters of demand, recovery proceedings, increasing age of accounts payable) ◻ Non-payment of statutory debts (e.g. PAYGW, SGC, GST) ◻ Poor or deteriorating working capital ◻ Increasing difficulties collecting debts ◻ Overdraft and/or other finance facilities at their limit ◻ Evidence of creditors attempting to obtain payment of outstanding debts ◻ Other, please specify ________________

Estimate the approximate amount of debts incurred after the date (in your opinion) of insolvency:

◻ $0 – $250,000 ◻ $250,001 – less than $1 million ◻ $1 million to $5 million ◻ Over $5 million ◻ Unable to determine

Do you have an aged creditors’ list as at (tick one or more):

◻ Date of insolvency ◻ Date of appointment

If the director/directors was dishonest in failing to prevent the company from incurring the debt, indicate what evidence you have available to support this (tick one or more):

◻ Evidence showing that the director/directors had an opportunity to prevent the company from incurring the debt and did not. Such evidence could include: • documents evidencing discussions with the directors, employees and creditors concerning the circumstances surrounding the incurring of particular debts; • correspondence or other documents relating to the circumstances surrounding the incurring of the debt. ◻ Evidence showing that the failure was dishonest (i.e., the director/directors incurred the debt with the knowledge that it would produce adverse consequences, the failure was intentional, wilful or deliberate, and it included an element of deceit or fraud). Such evidence could include: • documents evidencing discussions with the directors, employees and creditors concerning the circumstances surrounding the incurring of particular debts; • correspondence or other documents relating to the circumstances surrounding the incurring of the debt.

If you did not report insolvent trading (s588(1)-(2) or s588(3)), was it because, in your opinion:

◻ The books and records are insufficient to establish insolvent trading ◻ The company did not incur debts at a time when it was unable to pay its debts (e.g., it ceased to trade) ◻ The directors had reasons to expect the company could pay its debts as they fell due and payable (eg. they obtained independent advice) ◻ Other, please specify ________________

Has a creditor commenced, or indicated that they intend to commence, action to recover compensation for loss resulting from insolvent trading?

◻ Yes ◻ No

Insolvent trading may also be a breach of civil penalty sections 588G(1)-(2) of the Act. The revised form EX01 also seeks details of allegations of this nature, by asking about the period of insolvency, the methods and records used to determine the date of insolvency, the amount of debts incurred, and the reasonable grounds for the director had to suspect insolvency. The questions are practically the same as those asked when a criminal offence is alleged (see above). In the previous version of EX01 only three brief questions were posed, which concerned the availability of evidence and the perceived legitimacy of a director’s defence.

On 21 May 2014 ASESB issued an exposure draft of the proposed revisions. It is seeking feedback from insolvency accountants and “other stakeholders” by 4 July 2014.

Chairman of ASESB, Stuart Black, says

“The proposed new requirements to (the professional standard) APES 330 will further strengthen the professional requirements applicable to liquidators and administrators and provide a reference for creditors, regulators and other stakeholders to evaluate and monitor practitioner conduct”

The Media Release states that:

“APESB sets the code of ethics and professional standards by which members of Australia’s three major professional accounting bodies (CPA Australia, the Institute of Chartered Accountants Australia and the Institute of Public Accountants) are required to abide.”

The exposure draft contains the following list of “significant revisions” to the existing APES 330:

Mandating that where fee estimates are provided that these be provided in writing with explanations of the variables that may affect the estimated fee;

An obligation on the Member in Public Practice to provide details of Expenses that may be charged from the Administration and the basis of how the Expenses will be charged and recovered by the Firm;

Prohibition of Members in Public Practice claiming any pre-appointment disbursements as an Expense;

Where a Member in Public Practice accepts an Appointment with another Member, all Members are equally responsible for all decisions on the Appointment;

The deadline for stakeholder comments is 4 July 2014. APESB says it welcomes comments from respondents on any matters in the exposure draft (ED 01/14).

Comments should be addressed to:

The Chairman, Accounting Professional & Ethical Standards Board Limited

Level 7, 600 Bourke Street, MELBOURNE, VIC, 3000.

A copy of each submission will be placed on public record on the APESB website. http://www.apesb.org.au/apesb-exposure-drafts-open-for-comment.

APESB Media Release 21 May 2014

APESB At A Glance, APES 330 Insolvency Services ED, May 2014

Proposed Standard: apes 330 Insolvency Services

The Australian Restructuring Insolvency & Turnaround Association (ARITA) also has an extensive Code of Professional Practice. That governs members of ARITA, but has also been accepted by some judges in hearings concerning misconduct as a guide to the professional standards expected of all insolvency practitioners. Accordingly, the changes by the accounting bodies to APES 330 may not make much real difference to practice standards. But of course the accounting bodies must have their own rules in place.