Creators of ASIC’s ROCAP documents describe their process

Soon after the Australian Securities and Investments Commission (ASIC) issued a form titled “Report On Company Activities and Property“ (ROCAP), the creators of the form – the Communications Research Institute (CRI) – published an article describing the process they went through, their standards and the results of tests carried out.

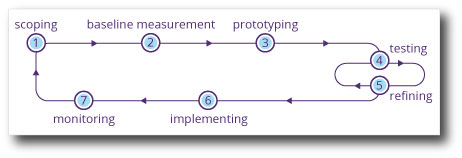

CRI form design procedure (Source: CRI)

The ROCAP – which replaced the Report as to Affairs (RATA) – is used in corporate insolvencies, where company directors are required to supply liquidators and other external administrators with details of a failed company’s present position, assets, liabilities and history.

Below is a copy of the article written in October 2018 by the head of CRI, Professor David Sless.

As the reader will see, CRI reports that “in the final round of testing (of the new form/documents) participants described the documents as ‘straightforward’ (and that) they easily followed both instructions and the related form-filling task.”

If that’s how the form and accompanying documents are received and processed in practice, it will be a welcome change. Because, by contrast, CRI says it found that “not a single director who participated in the CRI testing of the original RATA could use it appropriately”.

By now (June 2019) feedback to ASIC should indicate whether the new design developed by CRI has been a success, i.e., is regarded by directors and liquidators as more user-friendly and useful. CRI says that “once introduced, the forms and instructions will be carefully monitored and further refined or changed as needed.”

A NEW FORM HELPING FAILED COMPANIES

A Communications Research Institute (CRI) Model projectWHEN A COMPANY fails and an External Administrator is appointed, the Administrator sends a director of the company a form to complete by a set date. The form, known until now as the Report As To Affairs (RATA) had remained largely unchanged since the 19th century. The Australian Securities and Investment Commission (ASIC), which issues the RATA under the Corporations Act 2001, contracted CRI to develop a new design that would be:

- user friendly,

- consistent and logical,

- visually appealing,

- easy to read an complete.

CRI drew on its extensive research and practice in forms design spanning over three decades. CRI collaborated and consulted throughout the project with ASIC and a diverse group of professionals, academics, industry bodies, and former company directors, all of whom contributed to the design of the new form.

External administrators, in particular, who were the main RATA users told us that it failed to provide them with adequate information on the companies they administered. CRI, in consultation with ASIC determined that the needs of administrators had to be taken into account in the redesign.

Receiving the RATA is an unhappy and often traumatic experience for company directors. It marks the end of the company’s life, handing over its remains and final fate to an External Administrator who disposes of it and its assets in the best interests of its creditors. The feedback showed that in that handing over, filling out the RATA was itself traumatic.

Tellingly, not a single director who participated in the CRI testing of the original RATA could use it appropriately.

The redesign involved all aspects of the form’s structure, language, layout, colour and content, and a change of name from RATA to are more easily understood name: ROCAP – Report on Company Activities and Property. CRI undertook three rounds of designing, testing, and consultation with ASIC and stakeholders, followed by redesign.

The result is a totally new set of three documents to replace the RATA: Part A contains most of the RATA questions but in a totally new format, Part B contains new questions about the company records, history and management, and the third document contains detailed instructions for completing Parts A and B….

The instructions … are designed to exactly complement the questions, using the same numbering system throughout.

Observations from previous research shows that form users avoid reading instructions on a form because they see the task is primarily a form-filling task rather than are reading-and-form-filling task. In CRI’s designs, the instructions are always in a separate document, physically removed from the form filling tasks.

Careful design refinement of the navigation between the two documents as a result of testing enabled easy navigation between the two. In the final round of testing, participants describe the document as “straightforward”. They easily followed both instructions and the related form-filling task. The new design meets all CRI standards for good information design.

Once introduced, the forms and instructions will be carefully monitored and further refined or changed as needed.

Professor David Sless

Communication Research institute – October 2018

My previous posts on this subject are titled “Framework of new Report as to Affairs (RATA) drafted by ASIC” and “ASIC notifies liquidators that ROCAP is to replace RATA”.

I plan to post more articles about the new form and documents.