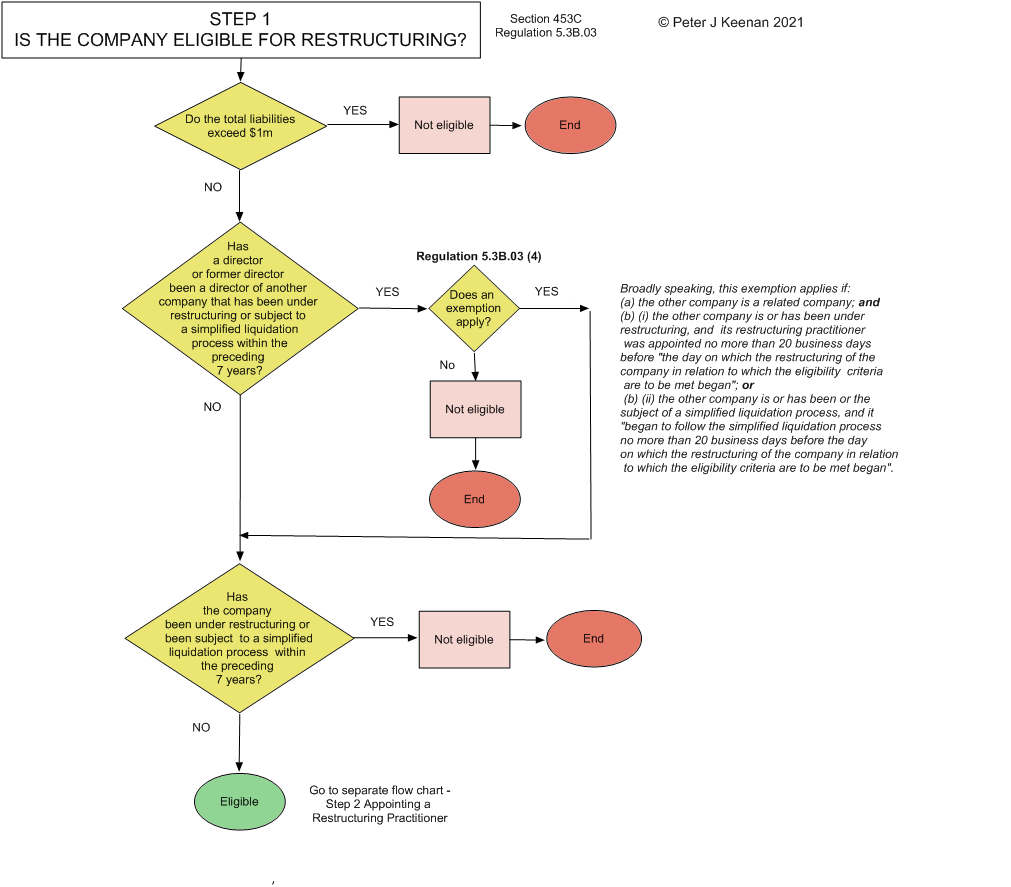

Decide by following this flow chart:

Temporary restructuring relief documents – ASIC Form EX07 – 1 January 2021. A cover sheet for lodging director declarations relating to temporary restructuring relief and related documents. Includes Guide. PDF format. Link to ASIC.

Director/s declaration of eligibility for temporary relief – ASIC form (no number) 1 January 2021. Related document to ASIC Form EX07 – see above. PDF format. Link to ASIC.

ASIC FAQs for company directors about temporary restructuring relief . Online pages. Headings: 1. Overview of the temporary restructuring relief. 2. Eligibility for temporary restructuring relief. 3. How does temporary restructuring relief end? 4. What a director must do if they realise the company is no longer eligible for temporary restructuring relief. Link to ASIC.

ASIC Guide for directors to publishing a notice of the declaration on the Published Notices Website. Online pages. Link to ASIC.

Warning: These extracts DO NOT FULLY COVER the subject. For a much more complete picture read the extensive guidance given by Australian Securities and Investment Commission (ASIC) and/or the legislation (see below).

It is important directors seek advice from a trusted adviser such as a suitably qualified financial adviser, accountant, registered liquidator or lawyer if they are considering whether eligibility for temporary restructuring relief…. The temporary restructuring relief extends, to 31 March 2021, certain measures implemented by the government to assist companies continue to operate during the COVID- 19 pandemic…. Directors must act before 31 March 2021 if they wish to access the temporary restructuring relief…. A company can access temporary restructuring relief if, during the period 1 January 2021 to 31 March 2021, the company directors make the required declaration about the company’s eligibility for temporary restructuring relief; and publish notice of the making of the declaration on the Published Notices Website. To ensure the temporary restructuring relief does not cease, directors must also give ASIC a copy of their declaration no later than 5 business days after it is made…. The period of relief only begins when the directors have made a declaration about the company’s eligibility for temporary restructuring relief and published notice of making the declaration on the Published Notices Website…. The initial temporary restructuring relief period can be extended for a further one month in some circumstances….

In response to the coronavirus pandemic the Australian Government, through the Department of Treasury, has issued a Fact Sheet of information about the part of it’s economic package that is designed “to lessen the threat of actions that could unnecessarily push (distressed businesses) into insolvency and force the winding up of the business.”

A copy of the Fact Sheet is available by clicking or touching HERE.

Soon after the Australian Securities and Investments Commission (ASIC) issued a form titled “Report On Company Activities and Property“ (ROCAP), the creators of the form – the Communications Research Institute (CRI) – published an article describing the process they went through, their standards and the results of tests carried out.

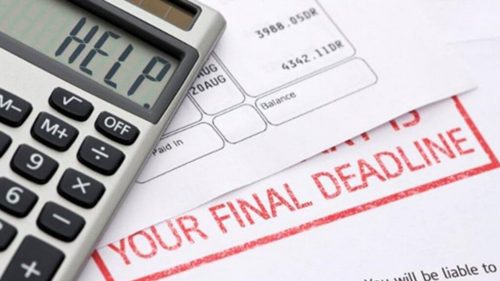

CRI form design procedure (Source: CRI)

The ROCAP – which replaced the Report as to Affairs (RATA) – is used in corporate insolvencies, where company directors are required to supply liquidators and other external administrators with details of a failed company’s present position, assets, liabilities and history.

Below is a copy of the article written in October 2018 by the head of CRI, Professor David Sless.

As the reader will see, CRI reports that “in the final round of testing (of the new form/documents) participants described the documents as ‘straightforward’ (and that) they easily followed both instructions and the related form-filling task.”

If that’s how the form and accompanying documents are received and processed in practice, it will be a welcome change. Because, by contrast, CRI says it found that “not a single director who participated in the CRI testing of the original RATA could use it appropriately”.

By now (June 2019) feedback to ASIC should indicate whether the new design developed by CRI has been a success, i.e., is regarded by directors and liquidators as more user-friendly and useful. CRI says that “once introduced, the forms and instructions will be carefully monitored and further refined or changed as needed.”

A NEW FORM HELPING FAILED COMPANIES

A Communications Research Institute (CRI) Model projectWHEN A COMPANY fails and an External Administrator is appointed, the Administrator sends a director of the company a form to complete by a set date. The form, known until now as the Report As To Affairs (RATA) had remained largely unchanged since the 19th century. The Australian Securities and Investment Commission (ASIC), which issues the RATA under the Corporations Act 2001, contracted CRI to develop a new design that would be:

- user friendly,

- consistent and logical,

- visually appealing,

- easy to read an complete.

CRI drew on its extensive research and practice in forms design spanning over three decades. CRI collaborated and consulted throughout the project with ASIC and a diverse group of professionals, academics, industry bodies, and former company directors, all of whom contributed to the design of the new form.

External administrators, in particular, who were the main RATA users told us that it failed to provide them with adequate information on the companies they administered. CRI, in consultation with ASIC determined that the needs of administrators had to be taken into account in the redesign.

Receiving the RATA is an unhappy and often traumatic experience for company directors. It marks the end of the company’s life, handing over its remains and final fate to an External Administrator who disposes of it and its assets in the best interests of its creditors. The feedback showed that in that handing over, filling out the RATA was itself traumatic.

Tellingly, not a single director who participated in the CRI testing of the original RATA could use it appropriately.

The redesign involved all aspects of the form’s structure, language, layout, colour and content, and a change of name from RATA to are more easily understood name: ROCAP – Report on Company Activities and Property. CRI undertook three rounds of designing, testing, and consultation with ASIC and stakeholders, followed by redesign.

The result is a totally new set of three documents to replace the RATA: Part A contains most of the RATA questions but in a totally new format, Part B contains new questions about the company records, history and management, and the third document contains detailed instructions for completing Parts A and B….

The instructions … are designed to exactly complement the questions, using the same numbering system throughout.

Observations from previous research shows that form users avoid reading instructions on a form because they see the task is primarily a form-filling task rather than are reading-and-form-filling task. In CRI’s designs, the instructions are always in a separate document, physically removed from the form filling tasks.

Careful design refinement of the navigation between the two documents as a result of testing enabled easy navigation between the two. In the final round of testing, participants describe the document as “straightforward”. They easily followed both instructions and the related form-filling task. The new design meets all CRI standards for good information design.

Once introduced, the forms and instructions will be carefully monitored and further refined or changed as needed.

Professor David Sless

Communication Research institute – October 2018

My previous posts on this subject are titled “Framework of new Report as to Affairs (RATA) drafted by ASIC” and “ASIC notifies liquidators that ROCAP is to replace RATA”.

I plan to post more articles about the new form and documents.

In an email to liquidators on 1 November 2018 the Australian Securities and Investments Commission has notified liquidators that its Report as to Affairs (RATA) form – Form 507 – is to be replaced by its new Report On Company Activities and Property (ROCAP) form – which comprises a new Form 507 plus a questionnaire. Directors and officers of companies entering into insolvent administration are required to complete the form and questionnaire.

Liquidators have been asked to issue the new ROCAP to directors for all new External Administrations after 1 November 2018, but says there will be a three-month transition period to allow software providers to catch up with the change.

A copy of the email is reproduced below.

For more about the new form and questionnaire, see my post “Framework of new Report as to Affairs (RATA) drafted by ASIC” (19/10/2018).

The new forms are available from ASIC: click HERE for the new ROCAP and HERE for the Instructions.

For more in this subject see my post of 22 June 2019: “Creators of ASIC’s ROCAP documents describe their process.”

![]() On 1 October 2018 the Australian Securities and Investments Commission (ASIC) released a draft of a new Report as to Affairs (commonly known as a RATA). A copy of this form, which includes detailed instructions, may be downloaded from my website or from this ASIC journal.

On 1 October 2018 the Australian Securities and Investments Commission (ASIC) released a draft of a new Report as to Affairs (commonly known as a RATA). A copy of this form, which includes detailed instructions, may be downloaded from my website or from this ASIC journal.

The new name of the report is to be Report On Company Activities and Property (ROCAP). ASIC intends releasing it in November 2018.

The following comments outline my preliminary analysis of the draft. Continue reading »

The Australian Securities and Investments Commission (ASIC) has reported on two successful convictions against directors for breaching their duties, in that they engaged in illegal phoenix activities.

The Australian Securities and Investments Commission (ASIC) has reported on two successful convictions against directors for breaching their duties, in that they engaged in illegal phoenix activities.

The reports are in two media releases, both published on 19 December 2017. Copies of the media releases appear below. But unfortunately, the media releases do not report on what, if anything, happened in relation to the assets of the stripped companies. If the only consequences of the phoenix activities were fines and, in one case, disqualification, there has been little in the way of deterrence.

As can be seen, one director was convicted and fined $5,000, and automatically disqualified from managing corporations for five years. His company (Brimarco) had all its funds – $34,800 – taken and transfered to a related company, leaving behind debts of $2 million. The release does not say whether the $34,800, or anything at all, was recovered.

The other director was discharged without conviction upon entering into recognisance in the sum of $2,000 on condition that she would be of good behaviour for two years. She sold the assets of her company (Greenlay Enterprises) to a related entity for $20,000, which appears to have been less than their market value. To make matters worse, the related entity did not actually pay the $20,000. The release does not say whether the assets, or an amount equal to their worth, or anything at all, was recovered.

From 18 September 2017 company directors will be able to seek shelter from liability for insolvent trading.

Previously, a director who caused a company to incur new debts (e.g., obtain goods and services on credit) at a time when the company was unable to pay its existing debts/liabilities, could – if the company was subsequently placed in liquidation – be sued by the liquidator or by the creditor provider.

Now, the laws will “protect a director in relation to debts that a company incurs directly or indirectly in connection with developing and taking a course of action that is reasonably likely to lead to a better outcome for the company than proceeding immediately to voluntary administration or winding up.” [Treasury Laws Amendment (2017 Enterprise Incentives No. 2) Bill 2017, Explanatory Memorandum, paragraph 1.32]

For the full history of this legislation – which encompasses “Safe Harbour for Insolvent Trading” laws and “ipso facto” clauses – and to see a discussion of the key issues (35 pages in all), click on this link: Parliamentary Library’s Bills Digest No. 33 of 11 September 2017.

TO BE CONTINUED …

The Turnbull Government is taking action to crack down on illegal phoenixing activity that costs the economy up to $3.2 billion per year to ensure those involved face tougher penalties, the Minister for Revenue and Financial Services, the Hon Kelly O’Dwyer MP, announced today.

Phoenixing – the stripping and transfer of assets from one company to another by individuals or entities to avoid paying liabilities – has been a problem for successive governments over many decades. It hurts all Australians, including employees, creditors, competing businesses and taxpayers.

The Government’s comprehensive package of reforms will include the introduction of a Director Identification Number (DIN) and a range of other measures to both deter and penalise phoenix activity.

The DIN will identify directors with a unique number, but it will be much more than just a number. The DIN will interface with other government agencies and databases to allow regulators to map the relationships between individuals and entities and individuals and other people.

In addition to the DIN, the Government will consult on implementing a range of other measures to deter and disrupt the core behaviours of phoenix operators, including non-directors such as facilitators and advisers. These include: Continue reading »

With the commencement on 1 September 2017 of the delayed parts of the Insolvency Law Reform Act 2016 (the ILRA), the Australian Securities and Investments Commission (ASIC) has updated some of the Information Sheets which it makes available on its website to the general public.

ASIC says that “Information sheets provide concise guidance on a specific process or compliance issue or an overview of detailed guidance.”

Over time ASIC has issued about 36 insolvency information sheets and flow charts (click here for my list). Below is a list of 15 which have recently been reissued.

In the past, nearly all ASIC’s information sheets have been available to download as printable sheets in PDF file format. However, this facility has not (yet) been provided with the updated/reissued sheets, which are only available as text on ASIC web pages. The links below are to the relevant website pages.

ASIC INSOLVENCY INFORMATION SHEETS – REISSUED 1 SEPTEMBER 2017 |

|||

Form Number |

Title of Sheet |

Date Updated |

Link to ASIC site |

| INFO 39 | Insolvency information for directors, employees, creditors and shareholders |

1/9/2017 |

INFO 39 |

| INFO 41 | Insolvency: A glossary of terms | 1/9/2017 | INFO 41 |

| INFO 42 | Insolvency: a guide for directors | 1/9/2017 | INFO 42 |

| INFO 43 | Insolvency: a guide for shareholders | 1/9/2017 | INFO 43 |

| INFO 45 | Liquidation: a guide for creditors | 1/9/2017 | INFO 45 |

| INFO 46 | Liquidation: a guide for employees | 1/9/2017 | INFO 46 |

| INFO 53 | Providing assistance to external administrators – Books, records and RATA | 1/9/2017 | INFO 53 |

| INFO 54 | Receivership: a guide for creditors | 1/9/2017 | INFO 54 |

| INFO 55 | Receivership: a guide for employees | 1/9/2017 | INFO 55 |

| INFO 74 | Voluntary administration: a guide for creditors | 1/9/2017 | INFO 74 |

| INFO 75 | Voluntary administration: a guide for employees | 1/9/2017 | INFO 75 |

| INFO 84 | Independence of external administrators: a guide for creditors | 1/9/2017 | INFO 84 |

| INFO 85 | Approving fees: a guide for creditors | 1/9/2017 | INFO 85 |

| INFO 152 | Public comment on ASIC’s regulatory activities | 1/9/2017 | INFO 152 |

| INFO 212 | Illegal phoenix activity | 1/9/2017 | INFO 212 |