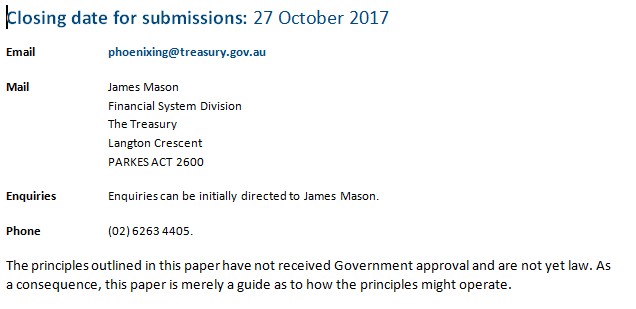

The Treasury has today (28 September 2017) released a consultation paper on reforms to address illegal phoenix activity. The closing date for submissions by interested parties is 27 October 2017.

The paper is available for download from the Treasury website.

Below is the foreword to the paper, by the Hon Kelly O’Dwyer MP, Minister for Revenue and Financial Services:

Phoenixing involves the stripping and transfer of assets from one company to another to avoid paying liabilities. It hurts all Australians, including employees, creditors, competing businesses and taxpayers, and has been a problem for successive governments over many decades.

Phoenixing has a significant financial impact – in 2012, the Fair Work Ombudsman and PwC estimated the cost of phoenixing to the Australian economy to be as high as $3.2 billion annually. It also undermines business’ and the public’s confidence in the corporate and insolvency sectors and the broader economy.

Companies fail for many different reasons, and it can be difficult to distinguish between those who are engaging in illegal phoenix activity and those who are simply involved in a failed company. We are committed to helping honest and diligent entrepreneurs who drive Australia’s productivity, but we won’t tolerate those who misuse the corporate form, to defeat creditors and rip off all Australians.

Phoenixing behaviour is becoming increasingly sophisticated and difficult to detect and deter within the existing legal and regulatory framework.

To address this, the Government is consulting on options for implementing a range of measures to deter and disrupt the core behaviours of phoenix operators, including non-directors such as facilitators and advisers. These are based on the recommendations of the Government’s Phoenix Taskforce. The Government recognises the need for carefully targeted reforms which minimise any impact on legitimate business activities and honest business restructuring.

These reforms will complement other Government action we have already taken, including:

- instituting the Phoenix, Black Economy and Serious Financial Crime Taskforces;

- strengthening disciplinary rules for insolvency practitioners;

- legislating to improve information sharing between key regulatory agencies;

- reviewing and enhancing ASIC’s powers and enforcement tools;

- consulting on law reform initiatives to curb the excessive drain on the taxpayer funded Fair Entitlement Guarantee scheme, which covers employees’ entitlements left outstanding as a result of failed business enterprises;

- improving the collection of GST on new residential premises and residential subdivision transactions from 1 July 2018;

- phasing in near real-time reporting by employers of payroll and superannuation information to the ATO through the single touch payroll reporting framework, giving the ATO improved visibility over employers’ compliance with their tax obligations including the superannuation guarantee;

- consulting on a register of beneficial ownership for companies, to be made available to key regulators for enforcement purposes; and

- developing and improving legislation to encourage and protect whistleblowers.

As part of its anti-phoenixing agenda, the Government is engaging with key stakeholders on the introduction of a Director Identification Number (DIN). A DIN will allow enforcement agencies to verify and track the current and historical relationships between directors and the entities they are associated with.

The Government seeks your views on the options for law reform outlined in this paper and encourages you to participate in the consultation process.

Sorry, the comment form is closed at this time.