Since mid-2012, when the Australian Securities and Investments Commission (ASIC) was given the power to wind up companies that met certain criteria, ASIC has ordered the winding up of

In its media releases ASIC has estimated that those 19 companies have over

As a result of the companies being wound up, those workers will be entitled to claim payment of their entitlements from the Fair Entitlements Guarantee (FEG) scheme administered by the Department of Employment.

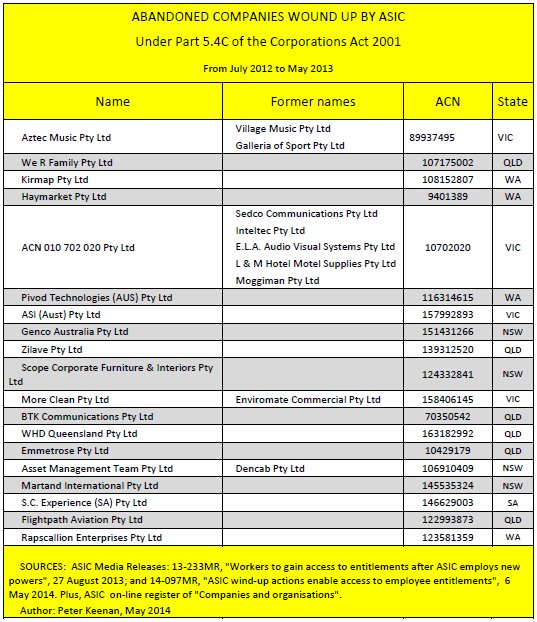

The following chart lists the 19 “abandoned companies” wound up by ASIC. They are called “abandoned” because ASIC believes they are no longer carrying on business and that their directors have effectively walked away from them and their debts.

Background:

In July 2012 ASIC was given the power to order the winding up of a company in certain circumstances [Part 5.4C of the Corporations Act 2001] [Section 489EA]. In the lead up to this legislation the phrase “abandoned companies” was coined to describe such companies. Shortly after obtaining these powers ASIC decided that its primary consideration when exercising its discretion would be whether ordering the winding up of a company would facilitate employee access to funds from the government’s General Employee Entitlements Scheme (GEERS), since replaced by the Fair Entitlement Guarantee scheme (FEG). [ASIC Consultation Paper 180]. This objective had been the main reason behind introduction of the new law, which was part of the Gillard Government’s Protecting Workers’ Entitlements package of April 2012. A precondition for an employee of a company receiving a payment from GEERS/FEG is that the company be placed into liquidation.

Links:

ASIC media release 13-233MR “Workers to gain access to entitlements after ASIC employs new powers” 27 August 2013 ASIC media release 14-097MR ” ASIC wind-up actions enable access to employee entitlements” 6 May 2014

Sorry, the comment form is closed at this time.